A financial report covering the period from the beginning of the current fiscal year to a specified date provides a snapshot of a company’s financial performance. This report summarizes revenues, costs, and expenses incurred, ultimately revealing net income or loss. It’s a crucial tool for monitoring business health and making informed decisions.

Utilizing such a report offers several advantages. It allows for timely performance evaluation, enabling proactive adjustments to strategy and operations. This ongoing monitoring facilitates informed budgeting and forecasting, enhancing financial control. Additionally, it provides essential data for stakeholders, including investors and lenders, demonstrating financial transparency and accountability.

Understanding the components and interpretation of this type of financial statement is essential for effective financial management. The following sections will delve into the key elements of this report, illustrating its practical application and demonstrating how it can be used to drive strategic decision-making.

1. Current Financial Year

The “current financial year” serves as the foundational timeframe for a year-to-date profit and loss statement. Understanding its parameters is crucial for accurate financial reporting and analysis. The statement encompasses all financial activity within the current fiscal period, providing a dynamic view of performance.

-

Fiscal Year Start and End Dates

A company’s fiscal year may not align with the calendar year. For example, a fiscal year could run from July 1st to June 30th. A year-to-date statement accurately reflects this specific period, ensuring all relevant financial data is included. Misalignment with the fiscal year leads to incomplete and potentially misleading reporting.

-

Impact on Reporting Periods

The current financial year dictates the scope of the year-to-date report. A statement generated mid-year only includes data from the fiscal year’s start through the reporting date. For instance, a report generated on October 31st for a fiscal year beginning July 1st covers only the first four months of operations. This dynamic nature allows for ongoing performance monitoring.

-

Comparison with Prior Periods

Analyzing year-to-date performance against the same period in the prior fiscal year provides valuable insights into trends and growth. This comparison requires consistent application of the current fiscal year’s start and end dates for both periods. Such analysis reveals the effectiveness of strategies implemented during the current fiscal year.

-

Implications for Financial Projections

Year-to-date performance serves as a critical input for forecasting future results and making informed business decisions. Accurate data within the current financial year provides a solid basis for projecting full-year performance and adjusting budgets and strategies accordingly. This allows for proactive course correction and optimization of resource allocation.

Accurate delineation of the current financial year is paramount for meaningful interpretation of year-to-date profit and loss statements. Precise reporting within these parameters provides a robust foundation for financial analysis, decision-making, and strategic planning.

2. Specified Reporting Date

The specified reporting date is a critical component of a year-to-date profit and loss statement template. It defines the cut-off point for data inclusion, providing a snapshot of financial performance up to a specific point within the fiscal year. Understanding the nuances of this date is essential for accurate interpretation and analysis.

-

Defining the Reporting Period

The specified reporting date demarcates the precise period covered by the statement. For a fiscal year beginning January 1st, a specified reporting date of June 30th signifies that the statement encompasses financial activity for the first six months. Selecting a different date, such as March 31st, would result in a statement covering only the first quarter. This precision allows for targeted performance evaluation at various intervals.

-

Impact on Performance Measurement

The choice of reporting date directly influences the financial results presented. Performance metrics, such as revenue, expenses, and net income, reflect activity only up to the specified date. Comparing statements with different reporting dates requires careful consideration of the differing timeframes. For example, comparing a year-to-date statement ending June 30th with one ending September 30th reveals performance trends over the intervening three months.

-

Facilitating Trend Analysis

Using a consistent reporting date across multiple periods enables effective trend analysis. Generating year-to-date statements with the same reporting date in consecutive years facilitates direct comparison of performance. This reveals growth patterns, identifies potential issues, and informs future strategic planning. For instance, comparing year-to-date performance as of June 30th for the current and prior years highlights year-over-year growth or decline.

-

Alignment with Business Objectives

The specified reporting date should align with business objectives and reporting requirements. Monthly reporting may be necessary for close monitoring of performance, while quarterly reporting might suffice for broader strategic reviews. Regulatory requirements may also dictate specific reporting dates. Aligning the reporting date with these needs ensures the relevance and utility of the financial information presented.

The specified reporting date is integral to the functionality and value of a year-to-date profit and loss statement template. Its careful selection ensures accurate representation of financial performance within the designated timeframe, enabling meaningful analysis, informed decision-making, and effective strategic planning.

3. Revenues and Gains

Revenues and gains constitute the positive side of a year-to-date profit and loss statement. Revenue represents income generated from a company’s primary business activities, while gains arise from peripheral transactions. Accurately capturing these figures within the specified reporting period is crucial for determining overall profitability. For example, a retail business’s revenue stems from merchandise sales, while the sale of a delivery truck might represent a gain. Both contribute to the overall financial picture presented by the statement.

A comprehensive understanding of revenues and gains within the context of a year-to-date statement provides valuable insights into business performance. Analyzing revenue trends can reveal the effectiveness of sales strategies, pricing models, and marketing campaigns. Monitoring gains can identify opportunities for optimizing asset utilization and divestiture strategies. For instance, consistent revenue growth within a specific product line suggests a successful market strategy, while a significant gain from the sale of an underutilized asset highlights efficient resource management. This analysis facilitates data-driven decision-making for future operations.

Accurate reporting of revenues and gains is essential for stakeholders such as investors, lenders, and management. This information provides transparency regarding a company’s financial health and ability to generate profit. Misrepresentation or omission of these figures can lead to inaccurate performance assessments and potentially misleading financial projections. A clear understanding of revenue streams and the nature of gains enables stakeholders to make informed judgments about a company’s financial stability and prospects. Integrating this data effectively into a year-to-date profit and loss statement template allows for a comprehensive and reliable evaluation of financial performance.

4. Costs and Expenses

Costs and expenses represent the outflow of funds incurred in generating revenue and operating a business within a given period. Accurate tracking and categorization of these outflows within a year-to-date profit and loss statement template are crucial for determining profitability and making informed financial decisions. Understanding the different types of costs and expenses and their impact on the bottom line is essential for effective financial management.

-

Cost of Goods Sold (COGS)

COGS represents the direct costs associated with producing goods sold by a business. For a manufacturer, this includes raw materials, direct labor, and manufacturing overhead. For a retailer, COGS represents the purchase price of merchandise resold. Accurately calculating COGS within a year-to-date timeframe provides insights into production efficiency and product profitability. For example, a rising COGS relative to revenue might indicate increasing material costs or production inefficiencies, requiring adjustments to pricing or production processes.

-

Operating Expenses

Operating expenses encompass the costs incurred in running the day-to-day operations of a business, excluding COGS. These include expenses such as rent, salaries, marketing, utilities, and administrative costs. Tracking operating expenses within a year-to-date context allows for monitoring operational efficiency and identifying areas for potential cost reduction. For instance, a significant increase in marketing expenses without a corresponding increase in revenue might necessitate a review of marketing strategies.

-

Depreciation and Amortization

Depreciation and amortization reflect the allocation of the cost of long-term assets over their useful lives. Depreciation applies to tangible assets like equipment and buildings, while amortization applies to intangible assets like patents and copyrights. Including these non-cash expenses in a year-to-date statement provides a more accurate picture of true profitability by recognizing the cost of using these assets over time. Consistent application of depreciation and amortization policies ensures comparability across reporting periods.

-

Interest Expense

Interest expense represents the cost of borrowing money. This expense is crucial for businesses that utilize debt financing. Tracking interest expense within a year-to-date statement helps assess the impact of financing decisions on profitability. Monitoring interest expense alongside revenue growth can reveal the effectiveness of leveraging debt to finance expansion. For instance, a high interest expense relative to revenue might necessitate exploring refinancing options or adjusting capital structure.

Careful categorization and analysis of costs and expenses within a year-to-date profit and loss statement template provide crucial insights into a company’s financial performance. Understanding the relationships between different cost categories, revenue, and profitability enables informed decision-making regarding pricing, cost control, and resource allocation. This analysis forms the basis for strategic adjustments aimed at maximizing profitability and ensuring long-term financial health.

5. Net Income/Loss Calculation

Net income/loss calculation represents the culmination of the year-to-date profit and loss statement, summarizing the overall financial performance for the specified period. It is derived by subtracting total costs and expenses from total revenues and gains. This figure provides a concise measure of a company’s profitability, reflecting its ability to generate profit after accounting for all expenses incurred during the year to date. The net income/loss calculation serves as a key performance indicator, informing stakeholders about the financial health and sustainability of the business. For example, a positive net income indicates profitability, while a negative net income (a net loss) signifies that expenses exceeded revenues during the reporting period. Understanding this calculation is fundamental to interpreting the overall financial position presented by the statement.

The placement of the net income/loss calculation at the bottom of the year-to-date profit and loss statement underscores its significance. It represents the final result of all financial activities summarized within the statement. This figure is often the primary focus for investors, lenders, and management when assessing financial performance. The net income/loss calculation directly impacts a company’s ability to reinvest in growth, distribute dividends, and attract further investment. Consistent profitability, reflected by a positive net income over time, demonstrates financial stability and enhances stakeholder confidence. For instance, a consistently growing net income might attract investors seeking long-term growth potential, while a declining net income could raise concerns about the company’s financial viability.

Accurate and transparent calculation of net income/loss is paramount for responsible financial reporting. Manipulating figures or employing misleading accounting practices can distort the true financial picture, potentially leading to misinformed decisions by stakeholders. Adherence to accounting standards and principles ensures the reliability and integrity of the net income/loss figure, promoting trust and transparency. This accuracy is crucial for internal decision-making as well, enabling management to make informed choices regarding pricing, cost control, and resource allocation. Ultimately, a clear and accurate net income/loss calculation within the year-to-date profit and loss statement template provides a critical foundation for evaluating financial performance and making sound strategic decisions.

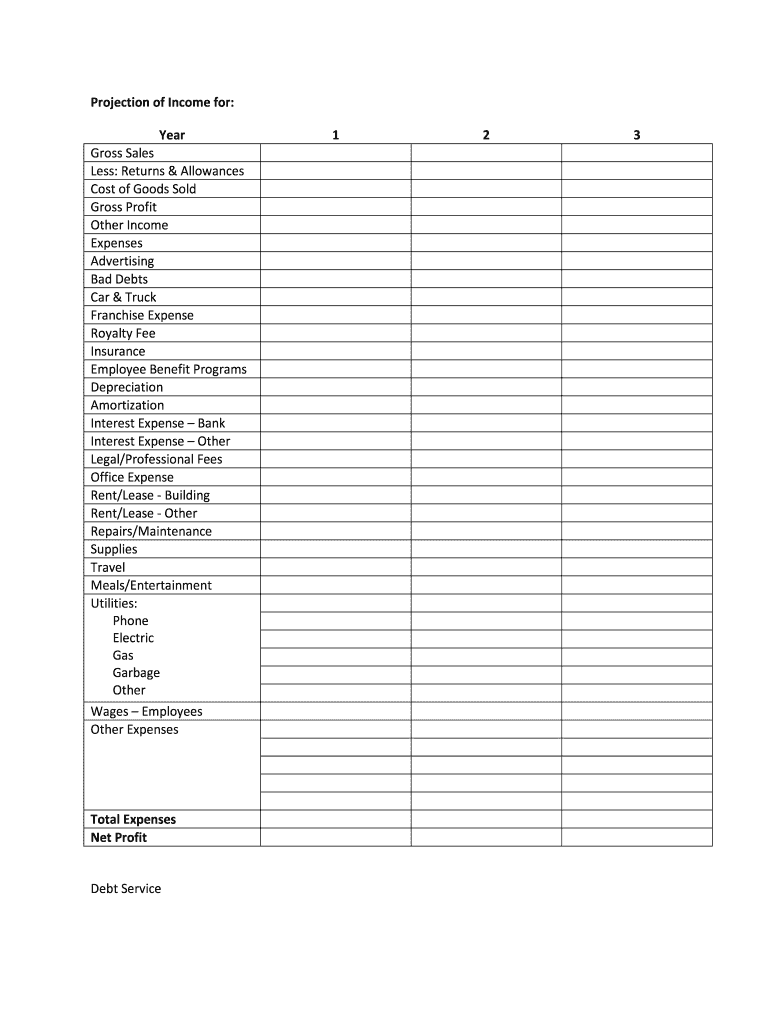

6. Pre-built template structure

A pre-built template structure provides a standardized framework for organizing and presenting financial data within a year-to-date profit and loss statement. This structure ensures consistency, accuracy, and efficiency in generating these crucial reports. Templates typically include predefined categories for revenues, expenses, and calculations, streamlining data entry and reducing the risk of errors. Using a template eliminates the need to create a new statement from scratch each reporting period, saving time and resources. For example, a template would include sections for revenue from sales, cost of goods sold, operating expenses, and the calculation of net income/loss. These predefined categories ensure that all essential financial data is captured consistently across reporting periods.

Leveraging a pre-built template offers several advantages. The standardized format facilitates comparison across different reporting periods, enabling trend analysis and identification of performance patterns. Templates also promote accuracy by minimizing manual data entry and ensuring consistent application of formulas and calculations. This consistency is crucial for reliable financial reporting and informed decision-making. Furthermore, using a template enforces adherence to accounting principles and standards, promoting transparency and accountability. For instance, a template would automatically calculate gross profit by subtracting the cost of goods sold from revenue, ensuring this calculation is performed consistently across all reports. This standardization facilitates accurate performance comparisons and trend analysis over time.

Understanding the significance of a pre-built template structure is fundamental to efficient and accurate financial reporting. Templates streamline the reporting process, reduce errors, and promote consistency, ultimately enabling informed financial management and strategic decision-making. While templates offer a robust framework, they must be adapted to reflect the specific needs and characteristics of each business. Regular review and updates to the template ensure its continued relevance and effectiveness in capturing the evolving financial dynamics of the organization. This adaptability, combined with the inherent structure and efficiency of a pre-built template, provides a powerful tool for managing and interpreting financial performance.

Key Components of a Year-to-Date Profit and Loss Statement Template

Effective analysis requires a clear understanding of the essential components comprising a year-to-date profit and loss statement. The following elements provide a framework for interpreting this crucial financial report.

1. Reporting Period: The specific timeframe covered by the statement, defined by the start of the fiscal year and the specified reporting date. This period dictates the scope of financial data included in the report. Accurate definition is essential for meaningful performance analysis.

2. Revenue: Income generated from primary business activities during the reporting period. This figure represents the top line of the statement and is a key driver of profitability. Accurate revenue recognition is crucial for assessing financial performance.

3. Cost of Goods Sold (COGS): Direct costs associated with producing or acquiring goods sold during the reporting period. Accurate COGS calculation is essential for determining gross profit and understanding product profitability.

4. Gross Profit: Calculated as Revenue minus COGS. This figure represents the profit generated from core business operations before considering operating expenses. Analyzing gross profit trends helps assess pricing strategies and production efficiency.

5. Operating Expenses: Costs incurred in running day-to-day business operations, excluding COGS. Examples include salaries, rent, marketing, and administrative expenses. Managing operating expenses effectively is crucial for overall profitability.

6. Operating Income: Calculated as Gross Profit minus Operating Expenses. This figure reflects profitability from core business operations after accounting for all operating costs. Operating income is a key indicator of a company’s operational efficiency.

7. Other Income/Expenses: Income or expenses not directly related to core business operations, such as interest income or expense, gains or losses from asset sales, and one-time charges. These items can significantly impact overall profitability.

8. Net Income/Loss: The bottom line of the statement, calculated by adding Other Income to (or subtracting Other Expenses from) Operating Income. Net income/loss represents the overall profitability of the business for the reporting period. This figure is a critical indicator of financial health and sustainability.

These components, when analyzed collectively, provide a comprehensive understanding of a company’s financial performance during the year to date. This information is essential for making informed decisions, optimizing resource allocation, and driving strategic planning.

How to Create a Year-to-Date Profit and Loss Statement Template

Creating a robust template ensures consistent and accurate tracking of financial performance throughout the fiscal year. The following steps outline the process of developing a comprehensive year-to-date profit and loss statement template.

1. Define the Reporting Period: Clearly establish the fiscal year start and end dates. This defines the overall timeframe for the year-to-date statement. The template should accommodate adjustments for the specified reporting date, allowing for flexible reporting at various intervals (monthly, quarterly, etc.).

2. Structure Revenue Categories: Establish clear categories for different revenue streams. This allows for detailed tracking of sales, services, or other revenue-generating activities. A well-defined structure facilitates analysis of revenue trends and identification of key performance drivers.

3. Outline Cost of Goods Sold (COGS): If applicable, create a section for COGS, outlining the direct costs associated with producing or acquiring goods sold. This section should include categories for materials, labor, and manufacturing overhead (for manufacturers) or purchase costs (for retailers).

4. Categorize Operating Expenses: Develop a comprehensive list of operating expense categories, including salaries, rent, utilities, marketing, and administrative costs. Detailed categorization enables effective expense management and identification of areas for potential cost reduction.

5. Incorporate Other Income/Expenses: Include sections for other income and expenses not directly related to core business operations. This might include interest income, investment gains, or one-time charges. Accurate tracking of these items provides a complete picture of financial performance.

6. Implement Calculations: Integrate formulas for calculating key metrics such as gross profit (Revenue – COGS), operating income (Gross Profit – Operating Expenses), and net income/loss (Operating Income +/- Other Income/Expenses). Automated calculations ensure accuracy and efficiency in generating reports.

7. Design for Flexibility and Scalability: The template should accommodate future growth and changes in business operations. Flexibility in adding or modifying revenue and expense categories ensures the template remains relevant and useful as the business evolves.

8. Choose a Suitable Format: Select a formatspreadsheet software, dedicated accounting software, or a cloud-based platformthat aligns with the organization’s technological capabilities and reporting requirements. The chosen format should facilitate data entry, automated calculations, and report generation.

A well-designed template provides a structured framework for consistently and accurately tracking financial performance throughout the year. Regular review and updates ensure the template’s continued effectiveness in meeting the evolving needs of the organization.

Financial reports covering performance from the beginning of the fiscal year to a specified date offer valuable insights into a company’s financial health. Understanding the components, including revenue, expenses, and net income/loss calculations, is crucial for informed decision-making. Utilizing a pre-built template ensures consistency, accuracy, and efficiency in generating these reports, providing a structured framework for analysis and interpretation. Proper utilization of such reports enables proactive adjustments to strategies and operations, informed budgeting and forecasting, and enhanced financial transparency for stakeholders.

Effective financial management hinges on accurate and timely data. Regularly generating and analyzing these statements promotes a proactive approach to financial control, allowing organizations to identify trends, address challenges, and capitalize on opportunities. This practice fosters financial stability and contributes significantly to long-term success. Integrating this process into routine operations empowers organizations with the financial intelligence necessary for sustained growth and informed strategic planning.