Utilizing a standardized structure offers several advantages. It facilitates consistent reporting, simplifies comparisons across different periods, and allows for efficient analysis of trends. This readily accessible overview enables informed decision-making by management, investors, and other stakeholders, contributing to improved financial planning and control.

This foundational understanding of year-to-date financial summaries will serve as a basis for exploring related topics such as key performance indicators, variance analysis, and forecasting methodologies.

1. Standardized Format

A standardized format is fundamental to the efficacy of a year-to-date profit and loss statement. Consistency in structure, labeling, and calculations ensures data comparability across different reporting periods. This allows for meaningful trend analysis, performance evaluation against benchmarks, and identification of potential issues. Without a standardized approach, comparing financial data becomes complex and prone to misinterpretation. For example, if revenue is categorized differently from one month to the next, assessing growth accurately becomes challenging.

Standardization also streamlines the process of generating these statements, reducing the risk of errors and improving efficiency. Templates with pre-defined formulas and categories ensure consistent data entry and minimize manual adjustments. This allows finance teams to focus on analysis rather than data compilation. Consider a multinational corporation consolidating financial data from various subsidiaries; a standardized format ensures uniformity across diverse accounting practices, enabling accurate reporting at the group level.

In summary, a standardized format promotes clarity, accuracy, and efficiency in financial reporting. It supports informed decision-making by providing a reliable and consistent view of year-to-date performance. While adapting the template to specific business needs might be necessary, the core principle of standardization remains essential for meaningful financial analysis and effective communication with stakeholders.

2. Year-to-date Data

Year-to-date (YTD) data forms the core of a YTD profit and loss statement template. It provides a cumulative perspective on financial performance from the beginning of the fiscal year up to a specific date. Understanding the nuances of YTD data is crucial for accurate interpretation and effective utilization of the information presented within the statement.

- Cumulative Performance:YTD data aggregates financial results, offering a comprehensive overview of performance trends. Rather than isolated snapshots of individual months, it presents a holistic view of how the business has performed over time. This cumulative perspective is crucial for evaluating progress against annual targets and identifying potential long-term issues. For example, while a single month might show a dip in sales due to seasonal factors, YTD data reveals the overall sales trajectory and its alignment with annual projections.

- Trend Analysis:Analyzing YTD data enables the identification of emerging trends in revenue, expenses, and profitability. This facilitates proactive adjustments to business strategies. For instance, consistently increasing operating expenses as a percentage of revenue, observed in YTD data, could signal inefficiencies requiring immediate attention. This allows businesses to address issues promptly rather than reacting to negative annual results.

- Benchmarking and Comparisons:YTD data provides a consistent basis for comparisons against previous periods or industry benchmarks. This allows for a relative assessment of performance and identification of areas for improvement. Comparing current YTD performance to the same period in the previous year can highlight growth or decline, indicating the effectiveness of existing strategies. Benchmarking against industry averages reveals competitive positioning and potential areas for optimization.

- Forecasting and Budgeting:YTD performance serves as a key input for forecasting future results and refining budget allocations. By extrapolating YTD trends and considering external factors, businesses can project year-end performance and adjust resource allocation accordingly. For example, strong YTD revenue growth might justify increased investment in marketing and sales to maximize potential, while lagging performance might necessitate cost-cutting measures.

The analysis of YTD data within the structured framework of a profit and loss statement template provides valuable insights into financial health and trajectory. It empowers stakeholders to make informed decisions regarding resource allocation, strategic planning, and performance optimization. The ability to identify trends, benchmark against competitors, and project future results based on YTD data is crucial for sustainable growth and long-term success.

3. Revenue and Expenses

A year-to-date profit and loss statement provides a comprehensive overview of a company’s financial performance by presenting a detailed breakdown of revenue and expenses. Accurate categorization and analysis of these two fundamental elements are crucial for determining profitability and making informed business decisions.

- Revenue Streams:Revenue represents the income generated from a company’s primary business activities. Within a YTD profit and loss statement, revenue is typically categorized by stream, allowing for analysis of individual performance drivers. For a software company, this might include subscription fees, licensing revenue, and professional services. Understanding the contribution of each revenue stream to overall performance allows for targeted strategies to maximize growth and profitability. For instance, identifying a declining revenue stream early in the fiscal year allows for timely intervention and corrective action.

- Cost of Goods Sold (COGS):COGS represents the direct costs associated with producing goods or services sold. This includes raw materials, direct labor, and manufacturing overhead. Accurate tracking of COGS is crucial for determining gross profit, a key indicator of operational efficiency. Analyzing YTD COGS allows for identifying trends in production costs and implementing measures to improve margins. For example, a consistent increase in raw material costs, observed through YTD analysis, might prompt exploration of alternative suppliers or process optimizations.

- Operating Expenses:Operating expenses encompass all costs incurred in running the business, excluding COGS. These typically include salaries, rent, marketing expenses, and administrative costs. Careful monitoring of operating expenses is essential for controlling overhead and maximizing profitability. YTD analysis of operating expenses helps identify areas of potential cost reduction and improve operational efficiency. For instance, a significant increase in marketing spend without a corresponding increase in revenue, observed in YTD data, might indicate the need to re-evaluate marketing strategies.

- Non-Operating Income and Expenses:Non-operating income and expenses relate to activities outside a company’s core business operations. These can include interest income, investment gains or losses, and one-time expenses. While less frequent, they can significantly impact overall profitability. Including these items in the YTD profit and loss statement provides a complete financial picture. For example, a significant gain from the sale of an asset, while positive, needs to be understood as a non-recurring event when projecting future performance.

A thorough understanding of revenue and expenses, categorized and analyzed within a YTD profit and loss statement, is fundamental to sound financial management. By tracking these elements year-to-date, businesses can gain valuable insights into profitability drivers, cost structures, and overall financial health, enabling data-driven decision-making and informed strategic planning.

4. Net Income/Loss

The net income/loss figure, representing the bottom line of a year-to-date profit and loss statement, is a crucial indicator of a company’s financial performance. It summarizes the overall profitability for the period by deducting total expenses from total revenues. A positive net income indicates profitability, while a negative net income, or net loss, signifies that expenses have exceeded revenues. Understanding the components contributing to this figure is essential for assessing financial health and making informed strategic decisions.

- Cumulative Profitability:Net income/loss on a YTD profit and loss statement represents the cumulative profit or loss from the beginning of the fiscal year to the present date. This provides a comprehensive view of performance, reflecting the combined impact of all revenue and expense activities over time. Analyzing trends in YTD net income/loss offers valuable insights into the overall financial trajectory and allows for early identification of potential issues.

- Key Performance Indicator:Net income/loss serves as a key performance indicator (KPI) for evaluating a company’s financial health and operational efficiency. It reflects the effectiveness of revenue generation and cost management strategies. Consistent monitoring of this metric is crucial for tracking progress against targets, benchmarking against competitors, and identifying areas for improvement. A declining YTD net income, for example, might signal the need to review pricing strategies or implement cost-cutting measures.

- Impact of Revenue and Expenses:Net income/loss is directly influenced by the interplay of revenue and expenses. Increases in revenue, assuming expenses remain constant or decrease, contribute to a higher net income. Conversely, rising expenses, without a corresponding increase in revenue, can lead to a lower net income or even a net loss. Understanding the relationship between revenue, expenses, and net income is crucial for informed financial management and strategic decision-making. For example, investing in research and development might initially increase expenses, but could lead to higher revenue and net income in the long term.

- Basis for Financial Ratios:Net income/loss figures are used to calculate various financial ratios, such as profit margin and return on equity, which provide deeper insights into a company’s financial health and profitability. These ratios are used by investors, creditors, and management to assess performance, make investment decisions, and evaluate creditworthiness. A consistently improving net income margin, observed through YTD analysis, enhances investor confidence and strengthens the company’s financial position.

Net income/loss, as presented on a YTD profit and loss statement, is a critical metric for assessing overall financial performance and making strategic decisions. By understanding the factors contributing to this figure and analyzing its trend over time, stakeholders gain valuable insights into a company’s profitability, operational efficiency, and long-term sustainability. This information is essential for informed resource allocation, strategic planning, and effective communication with investors and other stakeholders.

5. Performance Tracking

Effective performance tracking is essential for informed financial management. A year-to-date profit and loss statement template provides the structured data necessary for this crucial process. By analyzing year-to-date figures, businesses gain valuable insights into trends, identify potential issues, and make data-driven decisions to optimize performance and achieve strategic objectives.

- Key Performance Indicators (KPIs):KPIs, such as revenue growth, profit margins, and operating expense ratios, provide quantifiable measures of performance. A YTD profit and loss statement allows for tracking these KPIs over time, revealing trends and providing a basis for comparison against targets, previous periods, or industry benchmarks. For example, tracking gross profit margin on a YTD basis reveals whether profitability is improving or declining, enabling timely adjustments to pricing or cost management strategies.

- Variance Analysis:Variance analysis involves comparing actual results to budgeted or projected figures. The YTD profit and loss statement facilitates this analysis by providing the necessary data for calculating variances. Significant deviations from the budget, whether positive or negative, warrant further investigation and potential corrective action. For example, a significant negative variance in sales revenue for the YTD period signals the need to analyze sales performance, market conditions, and competitor activities.

- Trend Identification:Analyzing YTD data allows for identifying emerging trends in revenue, expenses, and profitability. This proactive approach enables timely adjustments to business strategies, maximizing opportunities and mitigating potential risks. For instance, a consistent upward trend in operating expenses as a percentage of revenue, observed in YTD data, could indicate operational inefficiencies requiring immediate attention.

- Forecasting and Budgeting:YTD performance serves as a crucial input for forecasting future results and refining budget allocations. By extrapolating YTD trends and considering external factors, businesses can project year-end performance and adjust resource allocation accordingly. For example, consistently strong YTD performance might justify increased investment in growth initiatives, while underperformance might necessitate cost-cutting measures or strategic adjustments.

Systematic performance tracking, facilitated by a YTD profit and loss statement template, empowers businesses to make data-driven decisions, optimize resource allocation, and enhance overall financial performance. By analyzing trends, identifying variances, and forecasting future results based on YTD data, organizations can proactively adapt to changing market conditions and achieve strategic objectives.

6. Informed Decisions

Sound financial decisions rely on accurate, timely, and comprehensive data. A year-to-date profit and loss statement template provides this critical foundation, enabling stakeholders to make informed decisions that drive operational efficiency, strategic planning, and long-term financial health. Analyzing year-to-date financial performance empowers businesses to understand current standings, identify trends, and project future outcomes, leading to more effective resource allocation and strategic adjustments.

- Strategic Planning:Understanding year-to-date profitability and expense trends informs strategic planning processes. For example, if a company’s YTD profit margin is consistently exceeding projections, it might consider expanding into new markets or investing in research and development. Conversely, if profits are lagging, the company might re-evaluate its pricing strategy or implement cost-cutting measures. The YTD profit and loss statement provides the necessary data to support these strategic decisions.

- Resource Allocation:Effective resource allocation requires a clear understanding of where resources are currently being utilized and their impact on profitability. YTD performance data allows businesses to identify areas where resources are generating the highest return and reallocate resources away from underperforming areas. For instance, if a particular product line is consistently generating losses, as evidenced by YTD data, the company might decide to discontinue that product line and allocate resources to more profitable products or services. This optimized resource allocation maximizes return on investment and contributes to overall financial health.

- Performance Evaluation:Evaluating the effectiveness of operational strategies requires consistent performance monitoring. YTD financial data allows for tracking progress against targets and identifying areas where performance is exceeding or falling short of expectations. This allows for timely intervention and corrective action. For example, if sales revenue is significantly below target for the YTD period, the company can analyze sales performance, identify contributing factors, and implement strategies to improve sales effectiveness.

- Investment Decisions:Investors rely on accurate and up-to-date financial information to make informed investment decisions. A YTD profit and loss statement provides a clear picture of a company’s current financial standing and its trajectory. This information is critical for assessing investment opportunities, evaluating risk, and making informed decisions about capital allocation. Consistent profitability, as demonstrated by positive and growing YTD net income, enhances investor confidence and attracts potential investments.

The ability to make informed decisions based on accurate and timely data is crucial for success in any business environment. A YTD profit and loss statement template provides the structured framework necessary for analyzing financial performance, identifying trends, and making strategic adjustments. By leveraging this information effectively, businesses can optimize resource allocation, improve operational efficiency, and achieve long-term financial sustainability.

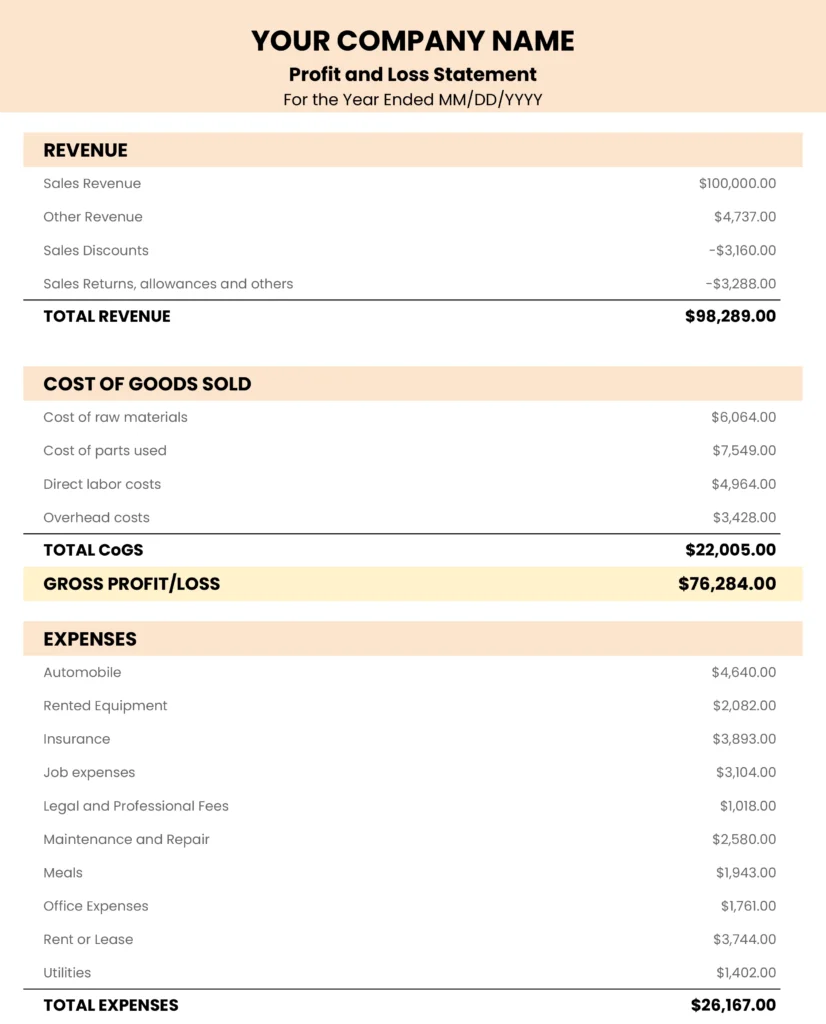

Key Components of a Year-to-Date Profit and Loss Statement

Effective financial analysis requires a structured approach. The following components are crucial for understanding financial performance within a year-to-date profit and loss statement.

1. Revenue: All income generated from sales of goods or services. This section typically includes a breakdown of revenue streams, allowing for analysis of individual performance drivers. Accurate revenue recognition is crucial for a reliable profit and loss statement.

2. Cost of Goods Sold (COGS): Direct costs associated with producing goods or services sold. This includes raw materials, direct labor, and manufacturing overhead. Accurate COGS calculation is essential for determining gross profit.

3. Gross Profit: Calculated as Revenue minus COGS. This metric represents the profit generated from core business operations before accounting for operating expenses. Gross profit margin, calculated as Gross Profit divided by Revenue, is a key indicator of operational efficiency.

4. Operating Expenses: Costs incurred in running the business, excluding COGS. Examples include salaries, rent, marketing, and administrative expenses. Careful management of operating expenses is crucial for profitability.

5. Operating Income: Calculated as Gross Profit minus Operating Expenses. This metric represents the profit generated from core business operations after accounting for all operating expenses. Operating income margin is a key indicator of overall operational profitability.

6. Other Income/Expenses: Income or expenses not directly related to core business operations. This can include interest income, investment gains or losses, and one-time expenses or income.

7. Income Tax Expense: The expense associated with income taxes owed. This is calculated based on applicable tax laws and regulations.

8. Net Income/Loss: The bottom line of the statement. Calculated as all revenues minus all expenses. This represents the overall profitability of the business for the year-to-date period.

A structured analysis of these components within a year-to-date profit and loss statement provides valuable insights for evaluating financial performance, identifying trends, and making informed decisions related to resource allocation and strategic planning. Accurate and consistent data within each component is essential for meaningful analysis and informed decision-making.

How to Create a Year-to-Date Profit and Loss Statement Template

Creating a robust year-to-date (YTD) profit and loss statement template requires careful consideration of key components and a structured approach. A well-designed template ensures consistency, facilitates accurate analysis, and supports informed decision-making.

1. Define Reporting Period: Specify the start and end dates for the YTD period. This ensures clarity and consistency in reporting.

2. Establish Chart of Accounts: Develop a comprehensive chart of accounts that categorizes all revenue and expense items. This structured system ensures consistent categorization and facilitates accurate tracking of financial data.

3. Design Template Structure: Create a clear and organized template structure with distinct sections for revenue, cost of goods sold (COGS), gross profit, operating expenses, operating income, other income/expenses, income tax expense, and net income/loss. This logical flow facilitates easy interpretation and analysis.

4. Incorporate Formulas and Calculations: Embed formulas within the template to automate calculations, minimizing manual data entry and reducing the risk of errors. Key calculations include gross profit (revenue – COGS), operating income (gross profit – operating expenses), and net income (total revenues – total expenses).

5. Data Input and Validation: Establish clear procedures for data input and validation to ensure data accuracy and integrity. Validation rules can prevent errors and ensure consistency in data formatting.

6. Review and Refinement: Regularly review and refine the template based on evolving business needs and reporting requirements. This ensures the template remains relevant and effective in supporting financial analysis and decision-making.

7. Integrate with Accounting System: If possible, integrate the template with the existing accounting system to automate data import and minimize manual data entry. This streamlines the reporting process and reduces the risk of errors.

8. Documentation and Training: Provide clear documentation and training to all users of the template to ensure consistent application and accurate data entry. This promotes standardization and enhances data reliability.

A well-structured template, incorporating these elements, provides a robust framework for analyzing YTD financial performance, supporting informed decision-making, and driving operational efficiency and long-term financial health. Consistent application and regular review ensure its continued effectiveness as a valuable tool for financial management.

Accurate and accessible financial data is fundamental to sound business management. A well-designed year-to-date profit and loss statement template provides a structured framework for capturing, analyzing, and interpreting critical financial information. From revenue streams and expense categories to net income calculations and key performance indicators, these structured summaries offer valuable insights into operational efficiency, profitability trends, and overall financial health. Standardization, accuracy, and consistent application of these templates are essential for meaningful analysis and informed decision-making.

Leveraging the insights derived from year-to-date financial analysis empowers organizations to make data-driven decisions regarding resource allocation, strategic planning, and performance optimization. Continuous monitoring, analysis, and adaptation based on these insights are crucial for navigating dynamic market conditions, mitigating potential risks, and achieving sustained growth and long-term financial success. The effective use of these financial tools contributes significantly to a robust and resilient business foundation.